Reducing Costs, Simplifing Processes and Improving Compliance

Introduction

Automating prior authorization (PA) has become a top priority for payers. What was once a cost-control tool is now an administrative burden draining payer resources and impacting member satisfaction. In this blog, we explore how healthcare payers can and are modernizing prior authorization through automation, AI, and standardization.

Key Payer Challenges in Prior Authorization Process

- Administrative Burden and Cost Pressures

- Lack of Standardization Across Providers and Plans

- Outdated Technology Infrastructure

- Balancing Cost Control with Quality, Timely Care

- Rising Regulatory and Market Pressures

Administrative Burden and Cost Pressures

Manual documentation handling, redundant touchpoints, and disconnected systems significantly increase payer operating costs. According to an American Medical Association (AMA) blog, manual PA costs U.S. payers over $1.3 billion annually.

Every step—from request intake and validation to review and communication—is riddled with inefficiencies. Even experienced teams spend countless hours reviewing paperwork, escalating exceptions, and updating legacy systems. While many insurers have already automated some areas of the process, there are more opportunities for time and cost savings.

Lack of Standardization Across Providers and Plans

The variability in benefit designs, clinical guidelines, and approval criteria leads to inconsistent documentation, higher rejection rates, and provider confusion.

63% of physicians reported difficulty in determining whether a prescription medication requires PA. Standardization is essential to improve predictability, trust, and operational efficiency.

Outdated Technology Infrastructure

Legacy systems lack the agility to support real-time workflows, provider EHR integrations, and predictive analytics. Outdated tech increases manual touchpoints and exposes organizations to compliance risks.

Balancing Cost Control with Quality, Timely Care

Payers must ensure strict controls without becoming barriers to care. Overly complex or opaque processes can erode member trust and provoke regulatory scrutiny.

As per the AMA’s prior authorization report, 88% of physicians reported PA interferes with continuity of care.

Rising Regulatory and Market Pressures

Mandates from CMS and states, along with public expectations, require greater transparency, faster turnaround, and fewer unnecessary denials. Compliance-driven innovation is now a necessity. CMS has mandated interoperability standards and response timelines for prior authorization requests for all impacted payers, which include Medicare Advantage, Medicaid, CHIP, and federally facilitated ACA plans.

Furthermore, as of late 2023, 40 states have enacted prior authorization regulations, with the possibility of additional and amended regulations constantly looming.

As part of this market pressure, over 50+ payers have made commitment to enact these changes across all their plans, including Commercial coverage. “Health plans are making voluntary commitments to deliver a more seamless patient experience and enable providers to focus on patient care, while also helping to modernize the system,” said AHIP President and CEO Mike Tuffin.

Strategic Recommendations: How Payers Can Tackle These Challenges

- Digitize the Prior Authorization Workflow

Modernize from paper/fax to real-time digital intake and processing with pre-built APIs, HL7/FHIR integrations, and digital triage systems. - Using AI to Streamline Prior Authorization Processes for Payers

Technologies like Gen AI, NLP, RPA, and OCR can automate document review, flag risks, validate eligibility, and provide explainable decisions. - Create a Centralized, Standardized Knowledge Framework

Establish a central engine for approval criteria, coverage rules, and regulatory guidelines to harmonize and publish to providers. - Enhance Transparency and Collaboration with Providers

Enable self-service provider portals, real-time status tracking, denial explanations, and provider education to reduce friction.

Modernization Framework for Payers

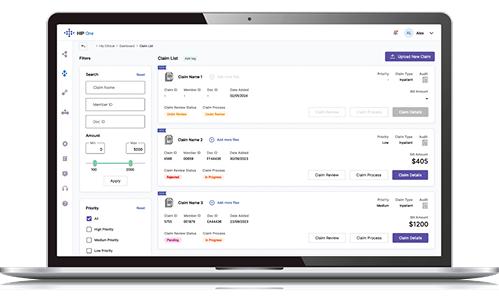

Genzeon’s HIP One Platform was built to meet the needs of prior authorization updates, and other payer clinical needs. HIP One, powered by GenAI, automates medical necessity analysis, flags gap, simulates clinical reasoning, and improves reviewer efficiency.

Genzeon’s HIP One Platform was built to meet the needs of prior authorization updates, and other payer clinical needs. HIP One, powered by GenAI, automates medical necessity analysis, flags gap, simulates clinical reasoning, and improves reviewer efficiency.

- Pre-Built Payer APIs: Seamlessly connect with EHRs, benefit systems, and triage engines.

- Automation-Driven Workflows: Utilize Gen AI, RPA, NLP, OCR, and chatbots to eliminate 30–40% of manual workload.

- Intelligent Dashboards: Visualize metrics like volume, turnaround, compliance, and approval trends.

Success Story: National Healthcare Payer Organization

Using HIP One with a on prem SLM, Genzeon improved transparency, auditability, and satisfaction in collaboration with our client. In several proof-of-concept (PoC) studies prior to launch, HIP One Medical Review consistently delivered a 30% reduction in manual interventions.

Learn more about our HIP One platform.

Key Takeaways for Payers

The good news? The tools, strategies, and frameworks exist today—and Genzeon is ready to help you deploy them.

- Prior authorization challenges extend beyond delays—they affect costs, compliance, and satisfaction.

- AI and automation can help payers streamline and scale operations.

- Standardization and provider collaboration reduce confusion and improve efficiency.

Frequently Asked Questions

Payers struggle with administrative burden, outdated systems, inconsistent documentation, and the need to balance cost control with timely care.

AI can automate documentation review, risk triage, and real-time decision support, reducing manual effort and improving accuracy.

Gen AI, RPA, NLP, OCR, and integrated APIs with provider systems are top technologies used to modernize PA workflows.

Standardization reduces provider friction, lowers errors, and improves approval predictability across health plans.